If you’re new to basketball and the NBA, chances are that you’ll need to have the NBA luxury tax explained. If that’s the case, then you’ve come to the right place.

Analysts and pundits often talk about how a team is over the luxury tax threshold or about the NBA luxury tax calculator. Simply put, the NBA’s luxury tax comes into place when a team exceeds the salary cap with their payroll. Several exceptions allow them to go over that top but they’ll still need to unload big sums of money in penalties.

NBA luxury tax explained

But, why would a team deliberately want to pay more fees and taxes? Well, that may be the only way of putting together a competitive roster, especially now that superstars are looking to team up to have an “easier” path to an NBA championship.

How does the NBA luxury tax work?

As it happens with most major American sports leagues, the NBA features a salary cap. That cap determines how much money a team can spend on its payroll and how much money the players can get on their extensions. That cap was set at $109.14 million for the 2019-20 season and it varies depending on the league’s collective bargaining agreement.

Teams that go over the league’s cap will pay taxes depending on different tiers. The tiers are set according to how much money that team has gone over the cap, and the money will be equally distributed among non-taxpaying teams.

What are the penalties for exceeding the NBA luxury tax?

The penalties for exceeding the NBA luxury tax vary depending on bracket-based amounts for each dollar by which a team’s payroll exceeds the soft cap.

Those brackets go from $5 million to $9,999,999, from $10 million to $14,999,999, then $15 million to $19,999,999 and above $20 million.

How is the luxury tax calculated?

Before the 2013-14 NBA season, teams paid one dollar per every dollar above the league’s cap.

Since that season, teams started paying at an incremented rate depending on the tiers we mentioned above. For instance, teams $20 million over the cap would have to pay $4.25 dollars per dollar. So, they would have to pay at least $85 million in taxes alone.

What is the NBA luxury tax apron?

But even if NBA teams can be above the NBA’s soft cap, there are still limits. For the 2019-20 season, the NBA luxury tax apron was set at a whopping $138.928 million. This is a figure which cannot be exceeded in any circumstances, and serves as a hard cap.

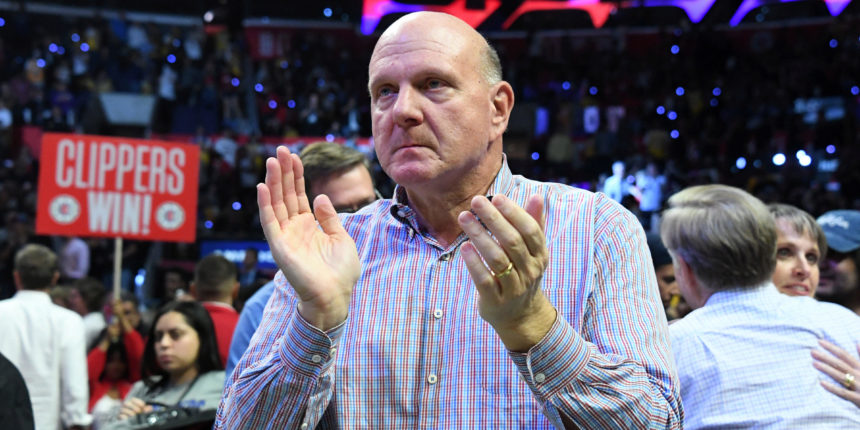

Nonetheless, no team is even close to paying that much right now. As of November 2021, the Golden State Warriors are projected to pay the most taxes around the league at around $184 million, followed by the Brooklyn Nets ($131 million), Los Angeles Clippers ($91 million), Milwaukee Bucks ($52 million), and Utah Jazz ($39 million).

Of all the mentioned teams, just the Golden State Warriors and Milwaukee Bucks have made the most of those luxury tax dollars by winning NBA championships. The remaining teams haven’t even made it to the NBA Finals in quite some time.

Comparisons with MLB and NFL salary cap systems

The biggest difference between the NBA’s luxury tax with the NFL is that the NBA has a soft cap, while the NFL has a hard cap. MLB has a luxury tax but with no official spending cap.

The NBA features several exceptions that allow teams to go over the tax, such as the Mid-Level Exception, Bi-Annual Exception, Rookie Exception, Early Bird Exception, Non-Bird exception, Minimum Salary exception, Traded Player Exception, and Disabled Player Exception.

Still learning about the league? We’ve got more NBA explained articles.

[spreaker type=player resource=”show_id=4112709″ width=”100%” height=”200px” theme=”light” playlist=”false” playlist-continuous=”false” chapters-image=”true” episode-image-position=”right” hide-logo=”false” hide-likes=”false” hide-comments=”false” hide-sharing=”false” hide-download=”true”]